SPOILER ALERT!

Checking Out Various Sorts Of Retired Life Communities: Searching For Your Perfect Fit

Material Author-Vester Chapman

Like locating the perfect fit of apparel, finding the appropriate retirement community will certainly involve some trial and error. However if you keep trying, you'll ultimately discover the perfect match.

Explore all the housing alternatives a retirement community uses, including their month-to-month prices and any entrance charges. When you go to, ask residents about their experiences and what they delight in most regarding the community.

For seniors that want to take pleasure in life without the job of preserving a home, independent living neighborhoods offer a range of features. These array from exercise courses to salon solutions to proceeding education and learning and art workshops. Several also have celebrations and adventures.

Depending on the type of retirement home, it is essential to consider what takes place if you or your enjoyed one requires extra care in the future. Make a checklist of the services and features that are crucial to you, after that check out those sorts of facilities to see if they will meet your needs.

Furthermore, make sure to ask what transportation options the facility provides. If you or your loved one sheds their ability to drive, maybe testing to go after social tasks, shop and keep doctor's appointments. Luckily, both retirement and Life Strategy areas typically give a range of onsite transport options. Often, entryway fees are refundable if you or your liked one ever before needs them.

Whether it is because of physical health concerns or just tired of raking fallen leaves and food preparation, several older grownups locate they need additional help with day-to-day living. That's when taking into consideration assisted living ends up being a choice.

When visiting assisted living areas, take into consideration the design of the personal houses. Inquire about furnishings options (can residents bring their very own), what sorts of home appliances they can have in the home, and if visitors are welcome overnight. You also intend to discover more regarding the available services, such as if shower rooms are made with security attributes like grab bars and if there are accessible areas to stroll both indoors and outdoors.

Another point to explore is the personnel. Find out about carf ccac and turn over rates and if background checks are carried out. And https://zenwriting.net/tena81elisha/the-advantages-of-socializing-in-a-retirement-community-a-comprehensive-guide forget to inquire about prices and contracts! The ideal community can aid you remain to live individually while receiving the treatment and help you require. https://squareblogs.net/jermaine63joey/the-ultimate-guide-to-selecting-the-right-retirement-home-for-your-lifestyle might also be partially covered by Medicare or long-lasting treatment insurance coverage.

Memory care neighborhoods provide the same services as lasting care areas yet have specialized services and a focus on aiding elders with mental deterioration. They use 24/7 treatment, with team member having actually specialized training in dealing with those who have memory loss or mental deterioration and often greater credentials like nursing accreditations. In addition to this, they often have attributes like color-coated hallways, easy-to-navigate floor plans, safety measures on doors and lifts, covered thresholds, softer flooring and even more.

When seeing memory treatment communities, inquire about the staff-to-resident proportion during the day and evening, and how they are educated to take care of emergency situations, recommends Eichenberger. Likewise, make certain they have the appropriate licensing and accreditation, and ask about pricing structures and extra fees. Ultimately, it is essential to see and observe their homeowners and see exactly how they engage with each other. This will offer you an idea of exactly how comfortable they'll really feel at the community.

In some cases seniors need experienced nursing care to handle their chronic ailment or recuperate from surgical treatment. Experienced nursing facilities, likewise known as nursing homes or SNFs, are controlled by the Centers for Medicare and Medicaid Provider (CMS) and Division of Public Health and occasionally evaluated to guarantee top quality criteria.

Unlike a health center, nursing homes have a lower staff-to-patient ratio and a more home setting. They additionally offer a vast array of rehabilitation and restorative solutions, including physical therapy and work treatment, speech therapy and injury care.

Some assisted living areas have a proficient nursing program that allows seniors to receive ongoing treatment without being uprooted from their area. When assessing choices, ensure to seek this choice and check whether it is covered by your senior enjoyed one's lasting treatment insurance coverage. Furthermore, make sure to explore the center face to face-- you'll have the ability to see direct how well the homeowners and staff connect.

Like locating the perfect fit of apparel, finding the appropriate retirement community will certainly involve some trial and error. However if you keep trying, you'll ultimately discover the perfect match.

Explore all the housing alternatives a retirement community uses, including their month-to-month prices and any entrance charges. When you go to, ask residents about their experiences and what they delight in most regarding the community.

1. Independent Living

For seniors that want to take pleasure in life without the job of preserving a home, independent living neighborhoods offer a range of features. These array from exercise courses to salon solutions to proceeding education and learning and art workshops. Several also have celebrations and adventures.

Depending on the type of retirement home, it is essential to consider what takes place if you or your enjoyed one requires extra care in the future. Make a checklist of the services and features that are crucial to you, after that check out those sorts of facilities to see if they will meet your needs.

Furthermore, make sure to ask what transportation options the facility provides. If you or your loved one sheds their ability to drive, maybe testing to go after social tasks, shop and keep doctor's appointments. Luckily, both retirement and Life Strategy areas typically give a range of onsite transport options. Often, entryway fees are refundable if you or your liked one ever before needs them.

2. Aided Living

Whether it is because of physical health concerns or just tired of raking fallen leaves and food preparation, several older grownups locate they need additional help with day-to-day living. That's when taking into consideration assisted living ends up being a choice.

When visiting assisted living areas, take into consideration the design of the personal houses. Inquire about furnishings options (can residents bring their very own), what sorts of home appliances they can have in the home, and if visitors are welcome overnight. You also intend to discover more regarding the available services, such as if shower rooms are made with security attributes like grab bars and if there are accessible areas to stroll both indoors and outdoors.

Another point to explore is the personnel. Find out about carf ccac and turn over rates and if background checks are carried out. And https://zenwriting.net/tena81elisha/the-advantages-of-socializing-in-a-retirement-community-a-comprehensive-guide forget to inquire about prices and contracts! The ideal community can aid you remain to live individually while receiving the treatment and help you require. https://squareblogs.net/jermaine63joey/the-ultimate-guide-to-selecting-the-right-retirement-home-for-your-lifestyle might also be partially covered by Medicare or long-lasting treatment insurance coverage.

3. Memory Care

Memory care neighborhoods provide the same services as lasting care areas yet have specialized services and a focus on aiding elders with mental deterioration. They use 24/7 treatment, with team member having actually specialized training in dealing with those who have memory loss or mental deterioration and often greater credentials like nursing accreditations. In addition to this, they often have attributes like color-coated hallways, easy-to-navigate floor plans, safety measures on doors and lifts, covered thresholds, softer flooring and even more.

When seeing memory treatment communities, inquire about the staff-to-resident proportion during the day and evening, and how they are educated to take care of emergency situations, recommends Eichenberger. Likewise, make certain they have the appropriate licensing and accreditation, and ask about pricing structures and extra fees. Ultimately, it is essential to see and observe their homeowners and see exactly how they engage with each other. This will offer you an idea of exactly how comfortable they'll really feel at the community.

4. Proficient Nursing

In some cases seniors need experienced nursing care to handle their chronic ailment or recuperate from surgical treatment. Experienced nursing facilities, likewise known as nursing homes or SNFs, are controlled by the Centers for Medicare and Medicaid Provider (CMS) and Division of Public Health and occasionally evaluated to guarantee top quality criteria.

Unlike a health center, nursing homes have a lower staff-to-patient ratio and a more home setting. They additionally offer a vast array of rehabilitation and restorative solutions, including physical therapy and work treatment, speech therapy and injury care.

Some assisted living areas have a proficient nursing program that allows seniors to receive ongoing treatment without being uprooted from their area. When assessing choices, ensure to seek this choice and check whether it is covered by your senior enjoyed one's lasting treatment insurance coverage. Furthermore, make sure to explore the center face to face-- you'll have the ability to see direct how well the homeowners and staff connect.

SPOILER ALERT!

Accepting Self-Reliance: The Advantages Of Elderly Apartments In Retired Life Communities

Personnel Writer-Neergaard Phelps

Elderly homes in retirement home are a terrific means for older grownups to get back to their roots and enjoy their retired life years. https://click4r.com/posts/g/13396344/ provide an active social setting and several facilities that can aid keep elders literally and mentally energetic.

The most effective part is that these living plans are less expensive than conventional homes. This provides senior citizens the flexibility to concentrate on things they like many.

Elderly apartment or condos in retirement communities are created with maturing grownups in mind and supply numerous safety and security attributes. As an example, they typically feature grab bars in bath tubs and around toilets and non-slip floor mats on hard flooring surfaces.

An additional benefit of senior apartment or condo living is that citizens can anticipate a series of conveniences such as housekeeping, laundry and transportation solutions. These services can make a big difference when it concerns streamlining life and maximizing time to take pleasure in favorite pastimes or tasks.

If you're thinking about relocating right into a senior house, be sure to speak with the staff at Otterbein to get the full photo. If possible, stay for lunch or a browse through with existing locals to obtain an exact sense of the community. Additionally, take into consideration just how much the regular monthly cost contrasts to the expenses of owning and maintaining a home and establish what functions rest on top of your concern list. Selecting a retirement home that lines up with your demands will certainly help you really feel much more confident in your decision.

In a retirement community, you can locate methods to stay physically energetic. As an example, you can join a tennis group or register for a woodworking course. Most areas likewise host events, which can be a great method to remain gotten in touch with next-door neighbors and discover brand-new rate of interests.

Numerous retired life apartments use housekeeping services and take care of maintenance, that makes it easier to concentrate on various other points. And it's simple to track costs because several expenses are consolidated into one month-to-month settlement.

Plus, https://blogfreely.net/lael263anjanette/retirement-home-vs-aging-in-place-making-the-very-best-choice-for-your-future bordered by individuals that are similar. This can aid you build friendships that last, which can fight sensations of solitude and anxiety. And it can be less complicated to get out and around, which helps reduce illness connected with isolation. This is why elderly apartment or condos in retirement home are in high need. They genuinely supply a way of living that can make you really feel young once again. Just ask the homeowners of GreenTree at Westwood.

When you live in an elderly apartment, dishes are dealt with for you. You can concentrate your time and energy on things you enjoy to do, while likewise concentrating on obtaining the nourishment you require.

Furthermore, life in a retirement community can be cheaper than living in your own home. Commonly, there are no ahead of time entrance costs and month-to-month rates are commonly more inexpensive than preserving your own home. Plus, read more suggests you can proceed spending as you choose.

If you are searching for a place to retire that can offer you with the liberty you prefer, think about elderly homes in retirement home. You can leave the lawn work and residence upkeep to others while still enjoying a complete social calendar, wellness classes and even more. You will have more leisure time to enjoy your leisure activities, occupy brand-new ones or invest high quality time with enjoyed ones. And also, all the comforts of home are nearby.

If you're made with handling a home upkeep routine, spending for expensive fixings and managing real estate tax, you'll discover that senior houses in retirement home supply more satisfaction. With less troubles, you can focus on having a good time, checking out with close friends and ruining the grandkids!

One more excellent feature of elderly houses in retirement home is that they're usually inhabited with citizens who are your age. So, you're most likely to be surrounded by people with similar interests and experiences who share your need for a carefree way of living.

To make it simpler to meet new buddies, consider making use of your neighborhood's usual locations. You can go out for a walk around the neighborhood, head to the cafe or sit down in a TV lounge to participate in tasks that allow you to connect with various other participants of the area. This is an excellent method to make new buddies and construct relationships that can last throughout your retirement.

Elderly homes in retirement home are a terrific means for older grownups to get back to their roots and enjoy their retired life years. https://click4r.com/posts/g/13396344/ provide an active social setting and several facilities that can aid keep elders literally and mentally energetic.

The most effective part is that these living plans are less expensive than conventional homes. This provides senior citizens the flexibility to concentrate on things they like many.

1. You Reach Do What You Desire

Elderly apartment or condos in retirement communities are created with maturing grownups in mind and supply numerous safety and security attributes. As an example, they typically feature grab bars in bath tubs and around toilets and non-slip floor mats on hard flooring surfaces.

An additional benefit of senior apartment or condo living is that citizens can anticipate a series of conveniences such as housekeeping, laundry and transportation solutions. These services can make a big difference when it concerns streamlining life and maximizing time to take pleasure in favorite pastimes or tasks.

If you're thinking about relocating right into a senior house, be sure to speak with the staff at Otterbein to get the full photo. If possible, stay for lunch or a browse through with existing locals to obtain an exact sense of the community. Additionally, take into consideration just how much the regular monthly cost contrasts to the expenses of owning and maintaining a home and establish what functions rest on top of your concern list. Selecting a retirement home that lines up with your demands will certainly help you really feel much more confident in your decision.

2. You Get to Stay Active

In a retirement community, you can locate methods to stay physically energetic. As an example, you can join a tennis group or register for a woodworking course. Most areas likewise host events, which can be a great method to remain gotten in touch with next-door neighbors and discover brand-new rate of interests.

Numerous retired life apartments use housekeeping services and take care of maintenance, that makes it easier to concentrate on various other points. And it's simple to track costs because several expenses are consolidated into one month-to-month settlement.

Plus, https://blogfreely.net/lael263anjanette/retirement-home-vs-aging-in-place-making-the-very-best-choice-for-your-future bordered by individuals that are similar. This can aid you build friendships that last, which can fight sensations of solitude and anxiety. And it can be less complicated to get out and around, which helps reduce illness connected with isolation. This is why elderly apartment or condos in retirement home are in high need. They genuinely supply a way of living that can make you really feel young once again. Just ask the homeowners of GreenTree at Westwood.

3. You Reach Consume Well

When you live in an elderly apartment, dishes are dealt with for you. You can concentrate your time and energy on things you enjoy to do, while likewise concentrating on obtaining the nourishment you require.

Furthermore, life in a retirement community can be cheaper than living in your own home. Commonly, there are no ahead of time entrance costs and month-to-month rates are commonly more inexpensive than preserving your own home. Plus, read more suggests you can proceed spending as you choose.

If you are searching for a place to retire that can offer you with the liberty you prefer, think about elderly homes in retirement home. You can leave the lawn work and residence upkeep to others while still enjoying a complete social calendar, wellness classes and even more. You will have more leisure time to enjoy your leisure activities, occupy brand-new ones or invest high quality time with enjoyed ones. And also, all the comforts of home are nearby.

4. You Get to Spend Even More Time With Friends

If you're made with handling a home upkeep routine, spending for expensive fixings and managing real estate tax, you'll discover that senior houses in retirement home supply more satisfaction. With less troubles, you can focus on having a good time, checking out with close friends and ruining the grandkids!

One more excellent feature of elderly houses in retirement home is that they're usually inhabited with citizens who are your age. So, you're most likely to be surrounded by people with similar interests and experiences who share your need for a carefree way of living.

To make it simpler to meet new buddies, consider making use of your neighborhood's usual locations. You can go out for a walk around the neighborhood, head to the cafe or sit down in a TV lounge to participate in tasks that allow you to connect with various other participants of the area. This is an excellent method to make new buddies and construct relationships that can last throughout your retirement.

SPOILER ALERT!

Financial Planning For Retirement Home Living: What You Need To Know

http://tanna049columbus.xtgem.com/__xt_blog/__xtblog_entry/__xtblog_entry/36003407-exploring-the-benefits-of-energetic-living-in-retired-life-communities?__xtblog_block_id=1#xt_blog Produced By-Herskind Munck

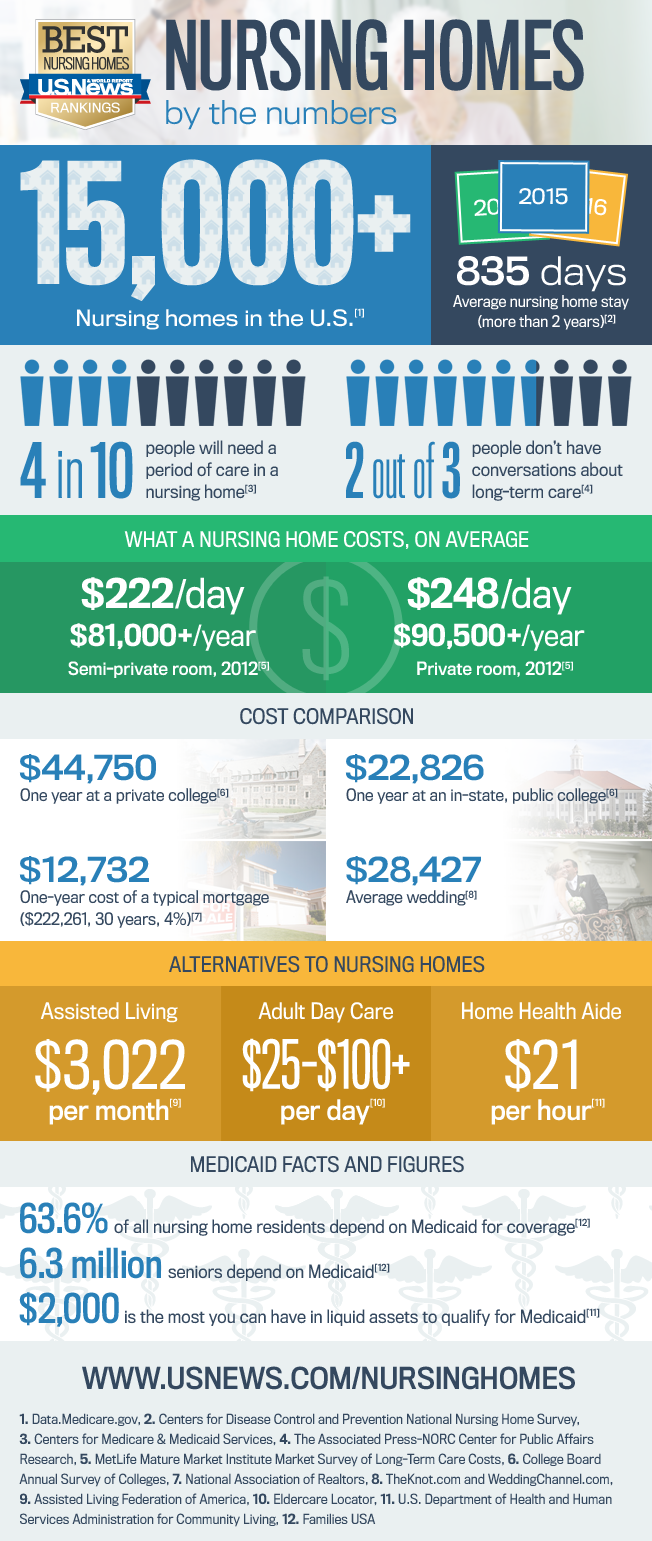

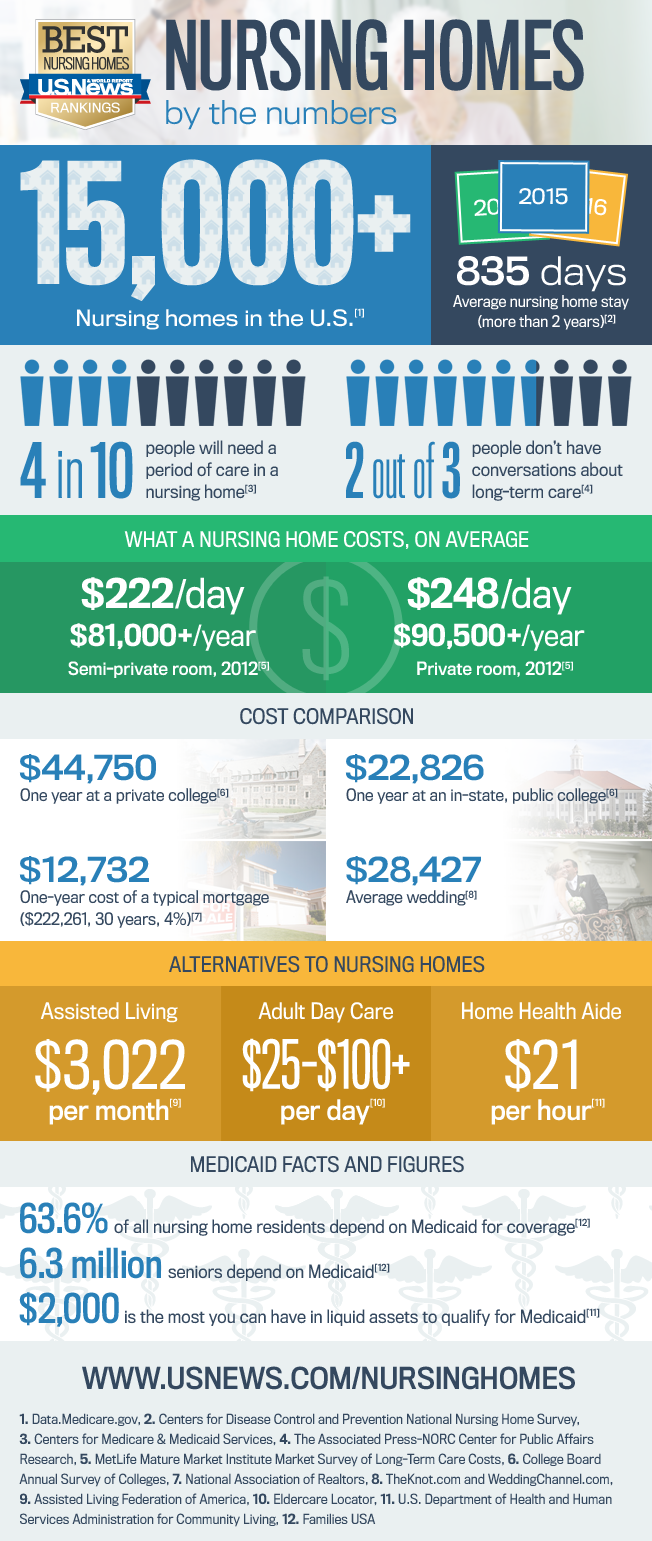

Paying for retirement home living requires careful monetary planning. Beginning by tallying up existing costs and contrasting them with prices of treatment at senior living areas.

Lasting care insurance (LTCI) is a preferred alternative for covering retirement community costs. Evaluation your plan to comprehend its terms, costs and insurance coverage.

Utilizing home equity is another common way to finance elderly living. However, accessing your home equity can have unpredicted repercussions.

When it concerns elderly living expenses, the earlier you start monetary preparing the much better. This gives you even more time to construct savings, financial investments, and explore different choices. A financial consultant can help you with the fundamentals and facility choices, consisting of exactly how to maximize your retirement income.

Accessing home equity is a popular method to spend for elderly living, however it is necessary to consider the pros and cons prior to deciding. For instance, selling your home might be less complicated than leasing or getting a reverse mortgage, however it can also impact your family members's funds in the short-term and decrease the quantity of living area you have.

Most Independent Living neighborhoods consist of housing, energies, meals, housekeeping, social activities, and transportation in their prices. Nonetheless, it's important to understand that fees often raise with time as the community requires to cover costs like personnel incomes, materials, and new features. Try to find a Life Strategy Area that provides an adaptable fee framework like Liberty Plaza's.

Having a precise understanding of their funds is crucial for seniors planning to transition into retirement home living. Start by compiling an extensive list of income sources and expenditures, including any type of set monthly prices like real estate, energies, auto settlements, insurance policy, and so on and those that change from month to month, such as groceries, home entertainment, and drugs.

When calculating their spending plan, elders must likewise consider the difference in price between a single-family home and a retirement home. This can help them figure out which choice might fit their demands and economic situation best.

When choosing springfield ma skilled nursing , make certain to ask about their rates framework and make note of any covert charges. Many areas respond to these questions regularly and are transparent regarding the expenses related to their care. If they're not, this must be a warning. Lastly, don't neglect to account for taxes. Both entrance and regular monthly fees at CCRCs that offer health care are qualified for tax deductions.

One of one of the most essential elements of retired life planning is making certain that you have enough cash to cover all of your expenditures. One method to do this is by establishing an emergency situation savings account, which must hold around 6 months of living expenses. Another means is to establish a regular transfer in between your bank account and your investment accounts, which will certainly guarantee that you are conserving frequently.

It's also a great concept to diversify your investments to ensure that you can weather market turbulence. linked internet site advised that you hold a profile that is comprised of 70% supplies and 30% bonds. If you are worried regarding stabilizing your threats and returns, take into consideration working with an economic specialist to locate a method that works finest for your demands.

Lots of seniors additionally locate it handy to buy lasting care insurance policy (LTCI) to cover the cost of assisted living, memory treatment, and assisted living home care. Nevertheless, it's necessary to examine LTCI plans very carefully to make sure that they cover your awaited expenses.

Lots of households choose to employ a financial organizer to aid with the planning procedure. These professionals can offer skilled suggestions on the ideas pointed out over and a lot more, like budgeting, tax obligation strategies, and facility decisions, such as selling a life insurance policy plan.

Those that plan to relocate into a retirement community ought to take into consideration all the costs they will face, consisting of housing fees, food, services, and transportation. This will help them to identify if they can manage the living expenses.

When contrasting prices, keep in mind that not all neighborhoods bill the same charges. Some are a lot more pricey than others, and the price of senior living can differ by area. Ask communities what their rates are and make certain that they address you truthfully and transparently. If an area is not versatile in its rates, that ought to be a red flag.

Paying for retirement home living requires careful monetary planning. Beginning by tallying up existing costs and contrasting them with prices of treatment at senior living areas.

Lasting care insurance (LTCI) is a preferred alternative for covering retirement community costs. Evaluation your plan to comprehend its terms, costs and insurance coverage.

Utilizing home equity is another common way to finance elderly living. However, accessing your home equity can have unpredicted repercussions.

Begin Early

When it concerns elderly living expenses, the earlier you start monetary preparing the much better. This gives you even more time to construct savings, financial investments, and explore different choices. A financial consultant can help you with the fundamentals and facility choices, consisting of exactly how to maximize your retirement income.

Accessing home equity is a popular method to spend for elderly living, however it is necessary to consider the pros and cons prior to deciding. For instance, selling your home might be less complicated than leasing or getting a reverse mortgage, however it can also impact your family members's funds in the short-term and decrease the quantity of living area you have.

Most Independent Living neighborhoods consist of housing, energies, meals, housekeeping, social activities, and transportation in their prices. Nonetheless, it's important to understand that fees often raise with time as the community requires to cover costs like personnel incomes, materials, and new features. Try to find a Life Strategy Area that provides an adaptable fee framework like Liberty Plaza's.

Develop a Budget

Having a precise understanding of their funds is crucial for seniors planning to transition into retirement home living. Start by compiling an extensive list of income sources and expenditures, including any type of set monthly prices like real estate, energies, auto settlements, insurance policy, and so on and those that change from month to month, such as groceries, home entertainment, and drugs.

When calculating their spending plan, elders must likewise consider the difference in price between a single-family home and a retirement home. This can help them figure out which choice might fit their demands and economic situation best.

When choosing springfield ma skilled nursing , make certain to ask about their rates framework and make note of any covert charges. Many areas respond to these questions regularly and are transparent regarding the expenses related to their care. If they're not, this must be a warning. Lastly, don't neglect to account for taxes. Both entrance and regular monthly fees at CCRCs that offer health care are qualified for tax deductions.

Testimonial Your Investments

One of one of the most essential elements of retired life planning is making certain that you have enough cash to cover all of your expenditures. One method to do this is by establishing an emergency situation savings account, which must hold around 6 months of living expenses. Another means is to establish a regular transfer in between your bank account and your investment accounts, which will certainly guarantee that you are conserving frequently.

It's also a great concept to diversify your investments to ensure that you can weather market turbulence. linked internet site advised that you hold a profile that is comprised of 70% supplies and 30% bonds. If you are worried regarding stabilizing your threats and returns, take into consideration working with an economic specialist to locate a method that works finest for your demands.

Lots of seniors additionally locate it handy to buy lasting care insurance policy (LTCI) to cover the cost of assisted living, memory treatment, and assisted living home care. Nevertheless, it's necessary to examine LTCI plans very carefully to make sure that they cover your awaited expenses.

Obtain Help

Lots of households choose to employ a financial organizer to aid with the planning procedure. These professionals can offer skilled suggestions on the ideas pointed out over and a lot more, like budgeting, tax obligation strategies, and facility decisions, such as selling a life insurance policy plan.

Those that plan to relocate into a retirement community ought to take into consideration all the costs they will face, consisting of housing fees, food, services, and transportation. This will help them to identify if they can manage the living expenses.

When contrasting prices, keep in mind that not all neighborhoods bill the same charges. Some are a lot more pricey than others, and the price of senior living can differ by area. Ask communities what their rates are and make certain that they address you truthfully and transparently. If an area is not versatile in its rates, that ought to be a red flag.

SPOILER ALERT!

A Day In The Life: What To Anticipate In A Vibrant Retirement Home

Web Content Composed By-Sander Richmond

Unlike other sorts of remote research studies that focus on specific product minutes, A Day in the Life research study zooms out to recognize just how items and procedures match your individuals' everyday lives.

An effective Day in the Life diary part generates a fire hose pipe of contextual data that you may not have captured via more targeted research studies.

Most retirement communities provide a series of tasks that are developed to keep elders active and engaged. Some popular tasks include art classes, problems (from word searches and sudoku to physical ones), self-defense courses, and baking or woodworking workshops.

Citizens might likewise participate in team tasks such as game night, bingo, and gelato socials. These can help citizens learn more about their neighbors while engaging in a fun and low-stress activity.

Various other activities could take the type of themed events that celebrate an era, a fashion style or event, and even a distinct hobby like weaving or shaping. This aids to advertise creativity and the feeling of accomplishment that features mastering a brand-new ability, while also developing a much deeper community. This can be especially essential for maturing grownups who could really feel separated in their own homes or after a relocate to elderly real estate.

Homeowners of retirement home are frequently used to having fresh, healthy dishes prepared and offered for them. At resident consumption, staff remember of every dietary specification and keep detailed documents for each individual's dish needs throughout their keep.

Numerous areas serve restaurant-style dishes at established times, but some also permit residents to consume in the convenience of their own houses or rooms any time of day. In-room dining is a terrific alternative for elders who aren't comfy in larger social setups.

An expanding variety of senior communities supply specialty menu products to cater to the requirements and preferences of their residents. Instances include low-sodium, low-fat, vegan/vegetarian and gluten-free choices. Some communities even partner with local dining establishments to offer a special culinary experience for locals.

Lively retirement communities offer several chances for homeowners to get in touch with peers and cultivate relationships. Activities often include interest-based groups such as book clubs, craft tasks, and yoga exercise courses; volunteer opportunities to repay; and group journeys to regional destinations.

Researches show that senior citizens with a fulfilling social life experience higher fulfillment with their lives and better cognitive capacities. They're also less likely to struggle with depression, which can lead to a number of significant wellness problems.

The human body can wish for social link similarly it provides for food or water. And while seclusion can occur for a variety of reasons, it's never a good idea for older adults. The psychological and physical repercussions of loneliness can be ravaging. Loneliness can also create an absence of motivation to consume well or take care of themselves.

When a community offers individual treatment, your liked one can get aid with everyday activities like showering and clothing. A treatment affiliate can also assist with drug administration and other health-related tasks.

Several retirement communities deal with maintenance tasks, such as cutting the lawn and managing home fixings, which frees up important time for older adults. Some even offer transportation options to assist homeowners get around community and attend gatherings and health care visits.

CCRCs or continuing care retirement home, usually supply 3 degrees of care: independent living, aided living and memory care. A resident relocations from degree to level as their demands alter. This helps in reducing the tension of transitioning out of an acquainted home and right into a new setting. Discover visit this web-site regarding our independent living, assisted living and memory treatment choices below at Three Columns.

Caring for a loved one day in and day out can wear on caregivers. It is necessary for caretakers to seek break and recharge often.

mouse click the following post can take lots of kinds. It may consist of employing family and friends to see your liked one so you can take a vacation or run tasks. It can also suggest taking advantage of out-of-home respite programs, such as adult preschool, family type homes or retirement home.

One more alternative is a short-term stay in an elderly living neighborhood. These stays can be as quick as a week or two or as long as three months, depending on your and your liked one's requirements. While you're away, the community's personnel can provide all the solutions your loved one normally gets, consisting of dishes, medication suggestions, and daily activities.

Unlike other sorts of remote research studies that focus on specific product minutes, A Day in the Life research study zooms out to recognize just how items and procedures match your individuals' everyday lives.

An effective Day in the Life diary part generates a fire hose pipe of contextual data that you may not have captured via more targeted research studies.

Tasks

Most retirement communities provide a series of tasks that are developed to keep elders active and engaged. Some popular tasks include art classes, problems (from word searches and sudoku to physical ones), self-defense courses, and baking or woodworking workshops.

Citizens might likewise participate in team tasks such as game night, bingo, and gelato socials. These can help citizens learn more about their neighbors while engaging in a fun and low-stress activity.

Various other activities could take the type of themed events that celebrate an era, a fashion style or event, and even a distinct hobby like weaving or shaping. This aids to advertise creativity and the feeling of accomplishment that features mastering a brand-new ability, while also developing a much deeper community. This can be especially essential for maturing grownups who could really feel separated in their own homes or after a relocate to elderly real estate.

Dishes

Homeowners of retirement home are frequently used to having fresh, healthy dishes prepared and offered for them. At resident consumption, staff remember of every dietary specification and keep detailed documents for each individual's dish needs throughout their keep.

Numerous areas serve restaurant-style dishes at established times, but some also permit residents to consume in the convenience of their own houses or rooms any time of day. In-room dining is a terrific alternative for elders who aren't comfy in larger social setups.

An expanding variety of senior communities supply specialty menu products to cater to the requirements and preferences of their residents. Instances include low-sodium, low-fat, vegan/vegetarian and gluten-free choices. Some communities even partner with local dining establishments to offer a special culinary experience for locals.

Socializing

Lively retirement communities offer several chances for homeowners to get in touch with peers and cultivate relationships. Activities often include interest-based groups such as book clubs, craft tasks, and yoga exercise courses; volunteer opportunities to repay; and group journeys to regional destinations.

Researches show that senior citizens with a fulfilling social life experience higher fulfillment with their lives and better cognitive capacities. They're also less likely to struggle with depression, which can lead to a number of significant wellness problems.

The human body can wish for social link similarly it provides for food or water. And while seclusion can occur for a variety of reasons, it's never a good idea for older adults. The psychological and physical repercussions of loneliness can be ravaging. Loneliness can also create an absence of motivation to consume well or take care of themselves.

Personal Treatment

When a community offers individual treatment, your liked one can get aid with everyday activities like showering and clothing. A treatment affiliate can also assist with drug administration and other health-related tasks.

Several retirement communities deal with maintenance tasks, such as cutting the lawn and managing home fixings, which frees up important time for older adults. Some even offer transportation options to assist homeowners get around community and attend gatherings and health care visits.

CCRCs or continuing care retirement home, usually supply 3 degrees of care: independent living, aided living and memory care. A resident relocations from degree to level as their demands alter. This helps in reducing the tension of transitioning out of an acquainted home and right into a new setting. Discover visit this web-site regarding our independent living, assisted living and memory treatment choices below at Three Columns.

Break

Caring for a loved one day in and day out can wear on caregivers. It is necessary for caretakers to seek break and recharge often.

mouse click the following post can take lots of kinds. It may consist of employing family and friends to see your liked one so you can take a vacation or run tasks. It can also suggest taking advantage of out-of-home respite programs, such as adult preschool, family type homes or retirement home.

One more alternative is a short-term stay in an elderly living neighborhood. These stays can be as quick as a week or two or as long as three months, depending on your and your liked one's requirements. While you're away, the community's personnel can provide all the solutions your loved one normally gets, consisting of dishes, medication suggestions, and daily activities.

SPOILER ALERT!

Retirement Community Living - Debunking Common Myths And Misconceptions

Uploaded By- https://writeablog.net/arianna1teressa/just-how-to-choose-the-right-retirement-home-for-your-lifestyle

If you remain in your later years and all set to create the next fantastic chapter of life, a retirement community can make it feasible. Learn more about some of one of the most typical myths bordering retirement home living.

Proceeding care retirement communities (CCRC) use numerous different levels of treatment, so if your wellness takes a turn for the worse, you can remain in your community and get the treatment you need.

As you investigate your choices, ask about entry fees. Usually, independent senior living near me when you relocate. This permits you to budget plan the cost right into your plan for your future.

Likewise, check out exactly how you'll access treatment. Some communities, like Sierra Winds, offer a Life Care contract that implies you'll get higher degrees of care in-house as your needs change.

Lastly, consider if you would certainly be happy living near individuals you want to hang around with. After all, socializing is another benefit of elderly living. Say goodbye to mowing, shoveling and various other chores that occupy your leisure time and power at home. Rather, you'll have the ability to take a walk with next-door neighbors or attend that coffee shop or art course. You can also take pleasure in a team dish with each other!

Respectable retirement communities have roomy homes with all the benefits you need for a comfy life. There are additionally everyday support team who can examine you when you're sick (or send you soup and a warm meal if that's what you require), change a lightbulb or assist with tasks-- whatever you need.

And while you may not require a lot of physical help, having a person to assist with those tasks that have been gradually ending up being harder and more time consuming can reduce the discomfort of a nagging back injury or an aging body. And also, an active schedule of events and activities will certainly maintain you occupied and make it very easy to satisfy other individuals with whom to mingle. activity village 'll discover a brand-new circle of pals.

A retirement home is a distinct living experience for senior citizens. Along with supplying a selection of services and amenities, locals typically take pleasure in lifelong understanding chances and social tasks.

These communities have different options that are based on what you need, such as independent living, assisted living and memory care. These neighborhoods additionally bill an entry charge to make certain that they have the resources to give top-tier facilities and-- in some circumstances-- health care solutions.

Those costs are generally tax obligation deductible as a pre-paid clinical cost. In the event that you need greater than a retirement home can provide, many have a generosity provision in their contracts to ensure you do not have to transfer to an additional place. Nevertheless, if you decide to move out, your entrance cost will not be refunded.

If you're considering retirement community living, it is very important to recognize what it is and isn't. While retirement communities provide lots of features and solutions, they are not nursing homes.

Rather, they give a safe and inviting atmosphere for elders to enjoy their lives to the fullest. They eliminate the need to maintain a big home, which can be stressful, and they likewise remove the demand to cut the lawn, rake fallen leaves or shovel snow.

On top of that, locals rate to host friends and family members in their personal houses any time. And if the day comes when you can no longer drive, a lot of retirement home supply onsite transport to location stores, sights and doctors' appointments. That implies you can navigate comfortably without bothering with traffic and that one motorist who is always quickly.

In some retirement home, next-door neighbors live very closely together and there is much less personal privacy. Likewise, they might be extra pricey than various other real estate choices and typically do not use medical care services.

Retirement home citizens can enjoy a variety of daily tasks. They can take pleasure in a cup of coffee in their very own apartment or condo, meet buddies for a water physical fitness class, and join their book club after dinner.

A CCRC uses an all-encompassing bundle of care. This includes independent living houses or homes, helped living, taking care of home treatment, and memory treatment. Whether you want help now or simply mindful that you may at some point call for care in the future, the assurance provided by a CCRC is invaluable. It can aid you feel great that your health and wellness requirements are taken care of for the remainder of your life.

If you remain in your later years and all set to create the next fantastic chapter of life, a retirement community can make it feasible. Learn more about some of one of the most typical myths bordering retirement home living.

Proceeding care retirement communities (CCRC) use numerous different levels of treatment, so if your wellness takes a turn for the worse, you can remain in your community and get the treatment you need.

1. You'll Have to Relocate

As you investigate your choices, ask about entry fees. Usually, independent senior living near me when you relocate. This permits you to budget plan the cost right into your plan for your future.

Likewise, check out exactly how you'll access treatment. Some communities, like Sierra Winds, offer a Life Care contract that implies you'll get higher degrees of care in-house as your needs change.

Lastly, consider if you would certainly be happy living near individuals you want to hang around with. After all, socializing is another benefit of elderly living. Say goodbye to mowing, shoveling and various other chores that occupy your leisure time and power at home. Rather, you'll have the ability to take a walk with next-door neighbors or attend that coffee shop or art course. You can also take pleasure in a team dish with each other!

2. You'll Be Alone

Respectable retirement communities have roomy homes with all the benefits you need for a comfy life. There are additionally everyday support team who can examine you when you're sick (or send you soup and a warm meal if that's what you require), change a lightbulb or assist with tasks-- whatever you need.

And while you may not require a lot of physical help, having a person to assist with those tasks that have been gradually ending up being harder and more time consuming can reduce the discomfort of a nagging back injury or an aging body. And also, an active schedule of events and activities will certainly maintain you occupied and make it very easy to satisfy other individuals with whom to mingle. activity village 'll discover a brand-new circle of pals.

3. You'll Need to Pay a Regular Monthly Fee

A retirement home is a distinct living experience for senior citizens. Along with supplying a selection of services and amenities, locals typically take pleasure in lifelong understanding chances and social tasks.

These communities have different options that are based on what you need, such as independent living, assisted living and memory care. These neighborhoods additionally bill an entry charge to make certain that they have the resources to give top-tier facilities and-- in some circumstances-- health care solutions.

Those costs are generally tax obligation deductible as a pre-paid clinical cost. In the event that you need greater than a retirement home can provide, many have a generosity provision in their contracts to ensure you do not have to transfer to an additional place. Nevertheless, if you decide to move out, your entrance cost will not be refunded.

4. You'll Have to Care for Your Home

If you're considering retirement community living, it is very important to recognize what it is and isn't. While retirement communities provide lots of features and solutions, they are not nursing homes.

Rather, they give a safe and inviting atmosphere for elders to enjoy their lives to the fullest. They eliminate the need to maintain a big home, which can be stressful, and they likewise remove the demand to cut the lawn, rake fallen leaves or shovel snow.

On top of that, locals rate to host friends and family members in their personal houses any time. And if the day comes when you can no longer drive, a lot of retirement home supply onsite transport to location stores, sights and doctors' appointments. That implies you can navigate comfortably without bothering with traffic and that one motorist who is always quickly.

5. You'll Have to Pay for Care

In some retirement home, next-door neighbors live very closely together and there is much less personal privacy. Likewise, they might be extra pricey than various other real estate choices and typically do not use medical care services.

Retirement home citizens can enjoy a variety of daily tasks. They can take pleasure in a cup of coffee in their very own apartment or condo, meet buddies for a water physical fitness class, and join their book club after dinner.

A CCRC uses an all-encompassing bundle of care. This includes independent living houses or homes, helped living, taking care of home treatment, and memory treatment. Whether you want help now or simply mindful that you may at some point call for care in the future, the assurance provided by a CCRC is invaluable. It can aid you feel great that your health and wellness requirements are taken care of for the remainder of your life.

SPOILER ALERT!

Retirement Community Living - Debunking Common Myths And Misconceptions

Created By-Bentley Riddle

If you remain in your later years and all set to create the following wonderful phase of life, a retirement community can make it possible. Find out about a few of the most common misconceptions bordering retirement home living.

Proceeding treatment retirement communities (CCRC) use several different degrees of care, so if your wellness takes a turn for the even worse, you can stay in your neighborhood and obtain the care you need.

As you investigate your choices, inquire about entryway fees. Usually, retirement home bill an one-time charge when you relocate. This allows you to spending plan the expense into your prepare for your future.

Also, look at just how you'll access care. https://zenwriting.net/steven1orville/understanding-the-financial-aspects-of-retired-life-communities , like Sierra Winds, offer a Life Treatment contract that means you'll get greater degrees of treatment in-house as your requirements change.

Finally, consider if you 'd enjoy living near individuals you want to spend time with. After all, socializing is one more advantage of elderly living. Bid farewell to mowing, shoveling and other tasks that use up your free time and energy in the house. Rather, you'll be able to take a walk with neighbors or participate in that coffeehouse or art class. https://click4r.com/posts/g/13391824/ can even enjoy a team meal together!

Trustworthy retirement communities have roomy apartments with all the conveniences you require for a comfortable life. There are additionally day-to-day support team who can check on you when you're sick (or send you soup and a hot dish if that's what you require), transform a lightbulb or aid with tasks-- whatever you require.

And while you might not require a great deal of physical support, having somebody to help with those jobs that have been progressively coming to be harder and even more time consuming can ease the discomfort of a nagging back injury or an aging body. And also, a busy calendar of events and tasks will keep you inhabited and make it very easy to fulfill other individuals with whom to mingle. You'll discover a new circle of buddies.

A retirement home is a distinct living experience for seniors. In addition to offering a variety of services and amenities, locals often delight in lifelong understanding opportunities and social activities.

These areas have various options that are based on what you need, such as independent living, assisted living and memory treatment. These communities additionally charge an entry cost to make certain that they have the sources to supply top-tier amenities and-- in some circumstances-- health care services.

Those costs are generally tax insurance deductible as a pre-paid clinical cost. In the event that you require more than a retirement community can use, the majority of have an altruism clause in their contracts to ensure you do not need to move to another place. Nevertheless, if you decide to move out, your entry cost will not be reimbursed.

If you're considering retirement home living, it's important to recognize what it is and isn't. While retirement home offer numerous features and services, they are not taking care of homes.

Instead, they provide a secure and inviting atmosphere for senior citizens to appreciate their lives to the maximum. They remove the requirement to maintain a large home, which can be stressful, and they likewise eliminate the requirement to mow the grass, rake leaves or shovel snow.

In addition, residents rate to host friends and family participants in their personal residences any time. And if the day comes when you can no longer drive, the majority of retirement communities supply onsite transportation to location shops, points of interest and doctors' visits. That indicates you can navigate comfortably without worrying about web traffic which one motorist who is always in a hurry.

In some retirement home, next-door neighbors live carefully together and there is less personal privacy. Likewise, https://www.rcmp-grc.gc.ca/en/seniors-guidebook-safety-and-security may be a lot more costly than various other real estate alternatives and commonly do not use healthcare solutions.

Retirement community locals can enjoy a selection of daily tasks. They can delight in a mug of coffee in their own apartment or condo, meet pals for a water fitness course, and join their publication club after supper.

A CCRC uses an all-inclusive plan of care. This consists of independent living apartments or homes, assisted living, taking care of home treatment, and memory treatment. Whether you need help now or simply cognizant that you might at some point need treatment in the future, the peace of mind provided by a CCRC is priceless. It can help you feel great that your health needs are dealt with for the rest of your life.

If you remain in your later years and all set to create the following wonderful phase of life, a retirement community can make it possible. Find out about a few of the most common misconceptions bordering retirement home living.

Proceeding treatment retirement communities (CCRC) use several different degrees of care, so if your wellness takes a turn for the even worse, you can stay in your neighborhood and obtain the care you need.

1. You'll Have to Move In

As you investigate your choices, inquire about entryway fees. Usually, retirement home bill an one-time charge when you relocate. This allows you to spending plan the expense into your prepare for your future.

Also, look at just how you'll access care. https://zenwriting.net/steven1orville/understanding-the-financial-aspects-of-retired-life-communities , like Sierra Winds, offer a Life Treatment contract that means you'll get greater degrees of treatment in-house as your requirements change.

Finally, consider if you 'd enjoy living near individuals you want to spend time with. After all, socializing is one more advantage of elderly living. Bid farewell to mowing, shoveling and other tasks that use up your free time and energy in the house. Rather, you'll be able to take a walk with neighbors or participate in that coffeehouse or art class. https://click4r.com/posts/g/13391824/ can even enjoy a team meal together!

2. You'll Be Alone

Trustworthy retirement communities have roomy apartments with all the conveniences you require for a comfortable life. There are additionally day-to-day support team who can check on you when you're sick (or send you soup and a hot dish if that's what you require), transform a lightbulb or aid with tasks-- whatever you require.

And while you might not require a great deal of physical support, having somebody to help with those jobs that have been progressively coming to be harder and even more time consuming can ease the discomfort of a nagging back injury or an aging body. And also, a busy calendar of events and tasks will keep you inhabited and make it very easy to fulfill other individuals with whom to mingle. You'll discover a new circle of buddies.

3. You'll Need to Pay a Regular Monthly Charge

A retirement home is a distinct living experience for seniors. In addition to offering a variety of services and amenities, locals often delight in lifelong understanding opportunities and social activities.

These areas have various options that are based on what you need, such as independent living, assisted living and memory treatment. These communities additionally charge an entry cost to make certain that they have the sources to supply top-tier amenities and-- in some circumstances-- health care services.

Those costs are generally tax insurance deductible as a pre-paid clinical cost. In the event that you require more than a retirement community can use, the majority of have an altruism clause in their contracts to ensure you do not need to move to another place. Nevertheless, if you decide to move out, your entry cost will not be reimbursed.

4. You'll Need to Care for Your Home

If you're considering retirement home living, it's important to recognize what it is and isn't. While retirement home offer numerous features and services, they are not taking care of homes.

Instead, they provide a secure and inviting atmosphere for senior citizens to appreciate their lives to the maximum. They remove the requirement to maintain a large home, which can be stressful, and they likewise eliminate the requirement to mow the grass, rake leaves or shovel snow.

In addition, residents rate to host friends and family participants in their personal residences any time. And if the day comes when you can no longer drive, the majority of retirement communities supply onsite transportation to location shops, points of interest and doctors' visits. That indicates you can navigate comfortably without worrying about web traffic which one motorist who is always in a hurry.

5. You'll Have to Spend for Treatment

In some retirement home, next-door neighbors live carefully together and there is less personal privacy. Likewise, https://www.rcmp-grc.gc.ca/en/seniors-guidebook-safety-and-security may be a lot more costly than various other real estate alternatives and commonly do not use healthcare solutions.

Retirement community locals can enjoy a selection of daily tasks. They can delight in a mug of coffee in their own apartment or condo, meet pals for a water fitness course, and join their publication club after supper.

A CCRC uses an all-inclusive plan of care. This consists of independent living apartments or homes, assisted living, taking care of home treatment, and memory treatment. Whether you need help now or simply cognizant that you might at some point need treatment in the future, the peace of mind provided by a CCRC is priceless. It can help you feel great that your health needs are dealt with for the rest of your life.

SPOILER ALERT!

Comprehending The Financial Aspects Of Retirement Communities

Article Created By-Ashley Ismail

The expense of living at retirement communities can vary substantially, making it important to ask every one of the right concerns and budget plan very carefully. With the help of this overview, you can make an educated decision that matches your demands and financial resources.

Study and estimate the prices related to your picked real estate alternative. This includes rent or home loan payments, real estate tax, home owners organization costs, and other housing expenditures.

Whether you're intending to transfer to a retirement community now or are just thinking of the possibilities in your future, it is essential to understand the monetary facets of senior living. By doing this, you can produce a budget and be prepared to manage prospective adjustments in your situation.

Residing in a retirement community supplies numerous advantages. For one point, you will not have to worry about trimming the lawn or raking leaves in the summertime. You won't have to shovel your driveway in the winter or find a person to repair the busted furnace. Plus, you'll have a great deal of social activities to select from, allowing you to make new good friends and pursue interests that may be tough to do while living alone.

However, moving to a retirement community is not affordable. There are costs related to residence, consisting of a single entrance charge and monthly maintenance or service fee. Some CCRCs provide a complete agreement that needs a larger initial repayment and a greater regular monthly charge, while others operate on a rental version without any upfront prices.

The majority of retirement home call for new citizens to pay a single entry charge. Depending upon the community, this fee can vary from $30k to $1 million or more. Likewise called a buy-in or refundable cost, it is developed to cover the price of future care and often prepays for part of your stay in an assisted living home, helped living, memory support, or proficient nursing center.

Some CCRCs use a "Lifecare" contract (Type A) while others operate on a fee-for-service version (Type C). Type An areas generally have a higher entrance fee, but warranty access to the entire continuum of healthcare solutions at a foreseeable rate and without additional expenses.

On the other hand, Type C communities have lower upfront fees however include enhanced levels of care to month-to-month service charge at market prices. In either situation, running long-lasting estimates can assist you compare the prices of various neighborhoods and determine which is right for your scenario.

A retirement home is a home-like atmosphere that supplies a variety of facilities to its homeowners. These facilities include security, upkeep and dining choices that enable seniors to enjoy their lifestyle without bothering with the headache of lawn maintenance or tackling their to-do list.

Some communities offer onsite health care solutions that are constructed right into their month-to-month service fees, allowing seniors to lock in small cost for future healthcare requirements. These kinds of neighborhoods are called Continuing Care Retirement Communities (CCRC) or Fee-for-Service CCRCs.

These communities also offer a feeling of neighborhood and a social atmosphere that can boost a senior's lifestyle. For instance, retirement home usually handle exterior landscaping jobs along with indoor maintenance to aid maximize elders' time and prevent them from taking the chance of injury performing challenging or harmful chores in the house. This allows them to invest their time doing things they enjoy or checking out family and friends.

Retirement home are commonly a lot more costly than staying in a residence however remove the demand for house owner's insurance coverage, property taxes and upkeep. Rather, a month-to-month service fee covers these expenditures in addition to a meal strategy, transport, accessibility to shared area rooms, occupation classes and other solutions.

An additional advantage of moving right into a retirement community is that maintenance tasks like landscaping, cutting the lawn and repairing devices are handled by team member. This can free up time for older grownups to concentrate on tasks that fascinate them and avoid injury as a result of literally requiring jobs.

Likewise, numerous retirement home provide on-site or nearby healthcare centers, which allows residents to conveniently obtain clinical aid if needed. This benefit helps reduce stress and boosts total health and wellness end results. https://journalistsresource.org/home/self-care-tips-for-journalists-plus-a-list-of-several-resources/ is additionally helpful for member of the family who could stress over their enjoyed ones being alone in case of an emergency.

The expense of living at retirement communities can vary substantially, making it important to ask every one of the right concerns and budget plan very carefully. With the help of this overview, you can make an educated decision that matches your demands and financial resources.

Study and estimate the prices related to your picked real estate alternative. This includes rent or home loan payments, real estate tax, home owners organization costs, and other housing expenditures.

Expenses

Whether you're intending to transfer to a retirement community now or are just thinking of the possibilities in your future, it is essential to understand the monetary facets of senior living. By doing this, you can produce a budget and be prepared to manage prospective adjustments in your situation.

Residing in a retirement community supplies numerous advantages. For one point, you will not have to worry about trimming the lawn or raking leaves in the summertime. You won't have to shovel your driveway in the winter or find a person to repair the busted furnace. Plus, you'll have a great deal of social activities to select from, allowing you to make new good friends and pursue interests that may be tough to do while living alone.

However, moving to a retirement community is not affordable. There are costs related to residence, consisting of a single entrance charge and monthly maintenance or service fee. Some CCRCs provide a complete agreement that needs a larger initial repayment and a greater regular monthly charge, while others operate on a rental version without any upfront prices.

Fees

The majority of retirement home call for new citizens to pay a single entry charge. Depending upon the community, this fee can vary from $30k to $1 million or more. Likewise called a buy-in or refundable cost, it is developed to cover the price of future care and often prepays for part of your stay in an assisted living home, helped living, memory support, or proficient nursing center.

Some CCRCs use a "Lifecare" contract (Type A) while others operate on a fee-for-service version (Type C). Type An areas generally have a higher entrance fee, but warranty access to the entire continuum of healthcare solutions at a foreseeable rate and without additional expenses.

On the other hand, Type C communities have lower upfront fees however include enhanced levels of care to month-to-month service charge at market prices. In either situation, running long-lasting estimates can assist you compare the prices of various neighborhoods and determine which is right for your scenario.

Resident Life

A retirement home is a home-like atmosphere that supplies a variety of facilities to its homeowners. These facilities include security, upkeep and dining choices that enable seniors to enjoy their lifestyle without bothering with the headache of lawn maintenance or tackling their to-do list.

Some communities offer onsite health care solutions that are constructed right into their month-to-month service fees, allowing seniors to lock in small cost for future healthcare requirements. These kinds of neighborhoods are called Continuing Care Retirement Communities (CCRC) or Fee-for-Service CCRCs.

These communities also offer a feeling of neighborhood and a social atmosphere that can boost a senior's lifestyle. For instance, retirement home usually handle exterior landscaping jobs along with indoor maintenance to aid maximize elders' time and prevent them from taking the chance of injury performing challenging or harmful chores in the house. This allows them to invest their time doing things they enjoy or checking out family and friends.

Maintenance

Retirement home are commonly a lot more costly than staying in a residence however remove the demand for house owner's insurance coverage, property taxes and upkeep. Rather, a month-to-month service fee covers these expenditures in addition to a meal strategy, transport, accessibility to shared area rooms, occupation classes and other solutions.

An additional advantage of moving right into a retirement community is that maintenance tasks like landscaping, cutting the lawn and repairing devices are handled by team member. This can free up time for older grownups to concentrate on tasks that fascinate them and avoid injury as a result of literally requiring jobs.

Likewise, numerous retirement home provide on-site or nearby healthcare centers, which allows residents to conveniently obtain clinical aid if needed. This benefit helps reduce stress and boosts total health and wellness end results. https://journalistsresource.org/home/self-care-tips-for-journalists-plus-a-list-of-several-resources/ is additionally helpful for member of the family who could stress over their enjoyed ones being alone in case of an emergency.

SPOILER ALERT!

Here Are Some Essential Suggestions For Selecting An Assisted Living Area:

Article written by-McGee McCarthy

If your parent is aging and also you need assist making treatment decisions for them, helped living may be an excellent option. Aided living communities are usually staffed by individuals that are professionals in their area. While their task is to market the center, there are some general guidelines that you need to follow when searching for a center.

Ensure the center you select offers tasks for seniors to maintain them energetic. Assisted living areas frequently have activities for residents that are created to engage them socially. They ought to likewise have communal dining areas and conference room where residents can gather as well as interact socially. In addition to intended tasks, elderly residents should also ask whether their neighborhood has a house cleaner to maintain their apartments tidy. Additionally, inquire about onsite features like laundry solutions. A personnel must have the ability to answer all your concerns and offer help in the kitchen area.

Assisted living residences might be staffed by qualified experts on a twenty-four-hour basis. Individual service strategies consist of objectives based on the behavioral background and preferences of the residents. They also consist of everyday tasks that help citizens live a complete as well as independent life. Some facilities give a full menu of food, 3 dishes daily, and also housekeeping solutions on a regular basis. A nurse reaction is offered 24-hour a day to manage medical emergency situations, such as drops, as well as a 24-hour emergency situation call system. Citizens can join a variety of programs, such as art courses, crafts, and video games.

The benefits of assisted living communities are numerous. Most importantly, residents delight in satisfaction. Households can rest simple recognizing that their loved one is receiving excellent care. In addition, elders benefit from recognizing that the neighborhood will certainly be there for them. The staff at assisted living neighborhoods will work to maintain residents secure and also comfy. If your enjoyed one needs care, they can benefit from the neighborhood's transport solutions. By doing http://donnie2cristi.total-blog.com/prior-to-picking-an-assisted-living-facility-you-ought-to-get-a-list-of-the-offered-centers-in-your-location-37372883 , they don't have to fret about driving, or getting shed.

While helped living is still an excellent alternative for lots of people, it is very important to remember that some facilities use nursing care. The majority of these communities will provide their residents with the right level of treatment they need. Furthermore, many centers will supply all natural like maintain them healthy and balanced and pleased. If your enjoyed one needs clinical attention, they can move on to nursing care in the community. If the clinical conditions of the homeowners are serious and also the atmosphere is not secure, they may have to leave.

The benefits of assisted living are numerous. Some assisted living neighborhoods offer a wide variety of services, consisting of drug monitoring, home cleaning, dishes, and laundry. Team gets on telephone call 1 day a day. Assisted living areas are also understood for their social programs. Some assisted living neighborhoods are particularly designed for memory care. Residents with this details condition might call for considerable aid with grooming as well as bathing. While independent living is an excellent option for people with moderate wellness issues, the majority of senior citizens need some degree of assistance to preserve their self-reliance.

If your relative has a limited earnings, you may be able to qualify for subsidized assisted living by the U.S. Division of Real Estate and also Urban Growth. https://wamu.org/story/19/06/03/choosing-the-right-assisted-living-community-tips-costs-and-more/ , additionally referred to as Section 8, can assist seniors spend for their aided living. However, because of https://blogfreely.net/maida8430lavelle/before-relocating-into-a-nursing-home-make-certain-you-understand-the , lots of waiting checklists exist for these programs. If you are eligible for a federal assistance program, contact your regional state for details. Many states additionally have a Medicaid resource to attend to Medicaid needs.

Assisted living centers provide specialist assistance with everyday activities. They also have much more amenities and also a lower staff-to-resident proportion. They are additionally certified by regional and also state agencies. In addition to promoting the advantages of nursing home, they offer an outstanding series of solutions for their homeowners. Nevertheless, you need to make certain to check out a couple of facilities before you make a decision. These facilities provide the needed services for your enjoyed one. So, consider a nursing home today!

Compared to taking care of residences, helped living is much more budget-friendly. The price of assisted living in the united state can be as low as $25,000 a year. This expense may rise if extra solutions are included in your package. However, assisted living costs are mainly paid by older citizens. Your medical insurance plan might cover the expenses of assisted living. Some residences may use financial support programs. It is a great suggestion to search prior to selecting a nursing home.

If your parent is aging and also you need assist making treatment decisions for them, helped living may be an excellent option. Aided living communities are usually staffed by individuals that are professionals in their area. While their task is to market the center, there are some general guidelines that you need to follow when searching for a center.

Ensure the center you select offers tasks for seniors to maintain them energetic. Assisted living areas frequently have activities for residents that are created to engage them socially. They ought to likewise have communal dining areas and conference room where residents can gather as well as interact socially. In addition to intended tasks, elderly residents should also ask whether their neighborhood has a house cleaner to maintain their apartments tidy. Additionally, inquire about onsite features like laundry solutions. A personnel must have the ability to answer all your concerns and offer help in the kitchen area.

Assisted living residences might be staffed by qualified experts on a twenty-four-hour basis. Individual service strategies consist of objectives based on the behavioral background and preferences of the residents. They also consist of everyday tasks that help citizens live a complete as well as independent life. Some facilities give a full menu of food, 3 dishes daily, and also housekeeping solutions on a regular basis. A nurse reaction is offered 24-hour a day to manage medical emergency situations, such as drops, as well as a 24-hour emergency situation call system. Citizens can join a variety of programs, such as art courses, crafts, and video games.

The benefits of assisted living communities are numerous. Most importantly, residents delight in satisfaction. Households can rest simple recognizing that their loved one is receiving excellent care. In addition, elders benefit from recognizing that the neighborhood will certainly be there for them. The staff at assisted living neighborhoods will work to maintain residents secure and also comfy. If your enjoyed one needs care, they can benefit from the neighborhood's transport solutions. By doing http://donnie2cristi.total-blog.com/prior-to-picking-an-assisted-living-facility-you-ought-to-get-a-list-of-the-offered-centers-in-your-location-37372883 , they don't have to fret about driving, or getting shed.

While helped living is still an excellent alternative for lots of people, it is very important to remember that some facilities use nursing care. The majority of these communities will provide their residents with the right level of treatment they need. Furthermore, many centers will supply all natural like maintain them healthy and balanced and pleased. If your enjoyed one needs clinical attention, they can move on to nursing care in the community. If the clinical conditions of the homeowners are serious and also the atmosphere is not secure, they may have to leave.

The benefits of assisted living are numerous. Some assisted living neighborhoods offer a wide variety of services, consisting of drug monitoring, home cleaning, dishes, and laundry. Team gets on telephone call 1 day a day. Assisted living areas are also understood for their social programs. Some assisted living neighborhoods are particularly designed for memory care. Residents with this details condition might call for considerable aid with grooming as well as bathing. While independent living is an excellent option for people with moderate wellness issues, the majority of senior citizens need some degree of assistance to preserve their self-reliance.